MEES: The Minimum Energy Efficiency Standard

Advice on the effect of MEES.

Landlords, Tenants, Investors, Developers and Lenders take note.

From 1 April 2018, a new Minimum Energy Efficiency Standard – MEES – applies to most rented commercial buildings. The introduction of MEES has wide-ranging effects for landlords, freehold investors, developers and lenders.

What is the minimum energy efficiency standard (MEES)?

The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 introduced the minimum energy efficiency standard (MEES). The MEES Regulations stem from the Energy Act 2011.

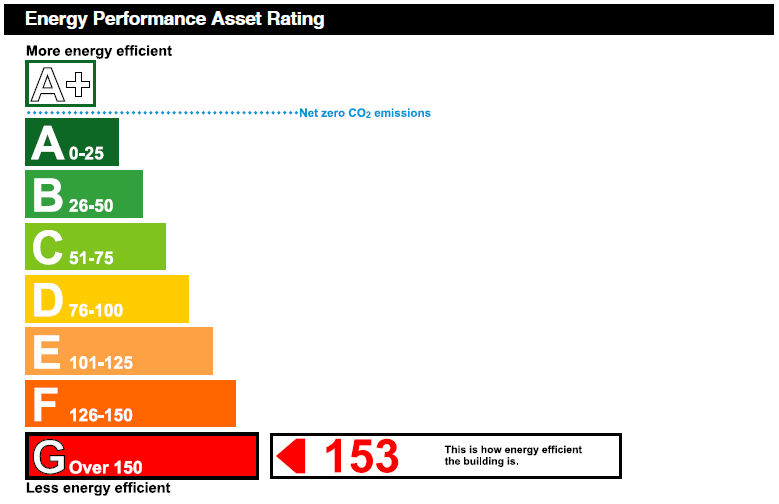

Before April 2018 commercial buildings on the market were only required to have an Energy Performance Certificate (EPC). EPCs rate a property’s energy efficiency from A – G. Properties with an EPC rating of F and G are the worst performing.

From 1 April 2018, landlords of buildings within the scope of the MEES Regulations must not renew existing tenancies or grant new tenancies if the building has an EPC rating of F or G, unless the landlord registers an exemption.

After 1 April 2023, landlords must not continue to let any buildings which have an EPC rating of less than E, unless the landlord registers an exemption. For example, if a property was let in 2015 with an EPC rating of F, a renewed tenancy would be unlawful unless the energy rating can be brought up to E or better.

Why has the government introduced MEES?

The built environment has been identified by the Government as a major contributor to greenhouse gas emissions. This is a threat to the UK meeting its carbon reduction targets for 2020 and 2050. The Government estimates that 18% of commercial properties have the lowest EPC ratings of F or G. Building Regulations ensure that new properties meet current energy efficiency standards and MEES will tackle the UK’s existing buildings.

It is important to note that the minimum standard could rise in future. Properties that only just meet the minimum standard now, may fall into a lower banding as standards improve. Properties in band E may be brought into the sub-standard category at some point in the future. The situation will evolve and efficiency standards will inevitably rise.

Which buildings and tenancies does MEES apply to?

Working out if a building and tenancy are caught within the scope of MEES is not always straightforward. MEES does not apply to:

- buildings which are not required to have an EPC.

- Examples include industrial sites, workshops, non-residential agricultural buildings with a low energy demand, certain listed buildings, temporary properties and holidays lets

- tenancies of less than 6 months (with no right of renewal),

- properties let on licence or where there is an agreement for lease

- leases of at least 99 years, such as a ground lease or a head lease.

Determining whether a building and tenancy are within scope requires owners to look at two sets of regulations: Energy Performance of Buildings (England and Wales) 2012 and the MEES Regulations. The interplay of the regulations is complex and creates some potential loopholes and grey areas that will no doubt be clarified by the Courts in the fullness of time. The government has published guidance that explains how MEES will apply in particular circumstances, such as leases of part of buildings.

What are the exemptions?

Landlords can let a building to which the MEES Regulations apply but which is below the minimum standard if any of the exemptions apply. These are:

- The ‘Seven Year Payback Test’: where an independent assessor determines that all relevant energy efficiency improvements have been made to the property or that improvements that could be made but have not been made would not pay for themselves through energy savings within seven years. There are numerous examples of “relevant” energy efficiency improvements which include double-glazing and pipework insulation which need to be considered. Wall-insulation measures are not required where an expert determines that these would damage the fabric of the property.

- Devaluation: where an independent surveyor determines that the relevant energy efficiency improvements that could be made to the property are likely to reduce the market value of the property by more than 5%.

- Third Party Consent: where consent from persons such as a tenant, a superior landlord or planning authorities has been refused or has been given with conditions with which the landlord cannot reasonably comply.

Exemptions must be registered on the central government PRS Exemptions Register.

The exemptions are valid for five years only and cannot be transferred to a new landlord.

What are the penalties for non-compliance?

The MEES Regulations are enforced by local authority Trading Standards. They have powers to impose civil penalties based on the property’s rateable value. They are set at a level to discourage landlords from breaching the regulations.

The penalty for renting out a property for a period of fewer than three months in breach of the MEES Regulations is equivalent to 10% of the property’s rateable value, subject to a minimum penalty of £5,000 and a maximum of £50,000.

After three months, the penalty rises to 20% of the rateable value, with a minimum penalty of £10,000 and a maximum of £150,000.

If a property is let in breach of the MEES Regulations or a penalty is imposed, the lease or tenancy remains valid and in force.

What are the threats and opportunities for landlords and what should they do?

The key obligations and restrictions in the MEES Regulations mainly fall on them Landlords.

The most obvious threat to landlords is the financial cost of upgrading non-compliant buildings. There is potential loss of income if a property cannot be rented out (including during the period it is having to be improved).

The provisions in existing leases may affect the statutory obligations of landlords under the MEES Regulations. For example:

- for a landlord hoping to delay compliance for as long as possible, standard leases may not contain sufficient restrictions on tenants subletting which could trigger the landlord’s obligations

- lease provisions on service charges, yielding-up and compliance with legislation may not allow a landlord to recover the capital expenditure required for improvements from the tenant

- for a landlord looking to make improvements, the landlord’s rights to enter may not extend to entry for installing energy efficiency improvements or there may be restrictions in a head lease to consider

- claims for dilapidations against tenants do not allow the landlord to claim for improvements to a property and works to bring a property up to the minimum threshold may count as improvements.

On a more positive note, there are opportunities for landlords to liaise with tenants to enter green leases where the environmental management and costs of the property, such as energy efficiency improvements and utility bills, are shared for the benefit of both parties.

There are also opportunities to explore the potential to increase rental and asset value through making energy efficiency improvements and combining these with other refit upgrades.

Landlords should:

- Assess their portfolios to understand which properties are affected by the MEES Regulations and whether exemptions might apply.

- Carry out energy assessments to check whether the EPC ratings for their properties are correct. (In several cases we have found that older EPCs have been prepared based on worst case assumptions giving poor energy ratings. Where a new EPC has been prepared using the correct inputs, the revised assessment often improves. An energy assessor can also advise on the most cost-effective way of reaching the minimum standards.)

- Understand how lease terms, break dates, renewals dates and planned refit periods fit with the MEES timetable above

- Review their leases to understand their rights.

- Revise lease terms to provide better interaction with MEES.

What is the impact on freehold investors and developers and what should they do?

Freehold investors (i.e. ground landlords) who own reversionary freehold assets are not landlords for the purposes of the MEES Regulations if the term of the head lease is 99 years or over. However, the MEES Regulations will still have an impact.

Ground landlords face a threat of a reduction in value of any property assets which do not meet the minimum standard and may struggle to find new tenant landlords willing to sub-let a property if it means they will need to carry out improvements.

On the other hand, freehold investors with tenant landlords already in place may benefit from having energy improvements made to their reversionary asset paid for by the head tenant.

Freehold investors may themselves be landlords for the purposes of the MEES Regulations if the fixed term of the head lease is less than 99 years. Where a property has more than one landlord, the question of which landlord is required to pay for installing energy efficiency improvements will depend on the terms of the head lease.

Developers who hold and let out freehold assets awaiting development could face similar issues to freehold investors. The MEES Regulations could create opportunities for developers by reducing the purchase cost of properties that are below the minimum standard.

Investors and developers should audit their portfolios to identify which properties are within the scope of the MEES Regulations. They should consider how the terms of the head leases and future development programmes fit with the MEES timetable above.

What is the impact on lenders and what should they do?

Lenders will also be affected by the MEES Regulations.

There is a threat to lenders where a building does not meet the minimum standard. This could lead to a reduction in value of their security and the borrower’s ability to let the property. In turn, this would affect the ability of a landlord borrower to make repayments due to loss of rental income and additional capital expenditure costs.

There is a further threat to lenders where they take possession of a property following default. They become freehold investors or landlords and subject to the MEES Regulations themselves.

Lenders should:

- obtain sufficient information when they commission valuations of assets that are used as security for loans to understand the impacts of MEES on their security so they can correctly price the risk and cost of borrowing

- reduce the potential risks by requiring that EPC certificates are provided by the borrower on all non-exempt lettings and/or requesting borrowers undertake and provide a MEES audit

- ensure their facility agreements provide suitable protections and rights against borrowers who fail to comply with their statutory obligations under the MEES Regulations.

Conclusion

The regulations are now in force.

Amendments in 2015 to the Energy Performance of Buildings (England and Wales) Regulations 2012 mean that local authorities are likely to become more active in taking enforcement action. They are required to report annually to the government on enforcement activity.

The government has published Guidance for Landlords. This is designed to help landlords, freehold investors, lenders and enforcement authorities to prepare for the MEES Regulations.

Do not delay getting to grips with how the MEES Regulations will affect your properties and devise the best strategy for compliance. Failure to understand the impact of the MEES Regulation could lead to increased costs for non-compliance later.

We can assist in sourcing reputable Energy Assessors, who can provide reliable energy performance ratings and can at the same time advise on the most cost effective means of bringing a property up to at least the minimum standard and into compliance.

We specialise in providing landlord and tenant advice, including the interpretation of repair covenants, landlord’s and tenant’s responsibilities and dilapidations issues. We will be happy to advise on any of these in relation to the MEES Regulations.

Back to news

Enquire today

Get in touch for more information about any of our services or help finding your perfect property

Property searchContact us